Content

https://www.bookstime.com/ will review all accounts to make sure there are no discrepancies, and balance a double-entry bookkeeping system to keep everything in check. Celebrate your success and hard work with your staff and board members by having an annual office party.

Several factors will determine the expenses of bookkeeping for a small company or non-profit. General purchases and deposits are handled by non-profit bookkeepers. Learn the theory behind a payroll accrual as well as the steps required to make the accrual journal entry and subsequent reversing journal entry in Macromedia Flash file format. You’ll need to download the zip file to your harddrive and save both files into the same directory then run the HTML file.

Use an Experienced Nonprofit Bookkeeper

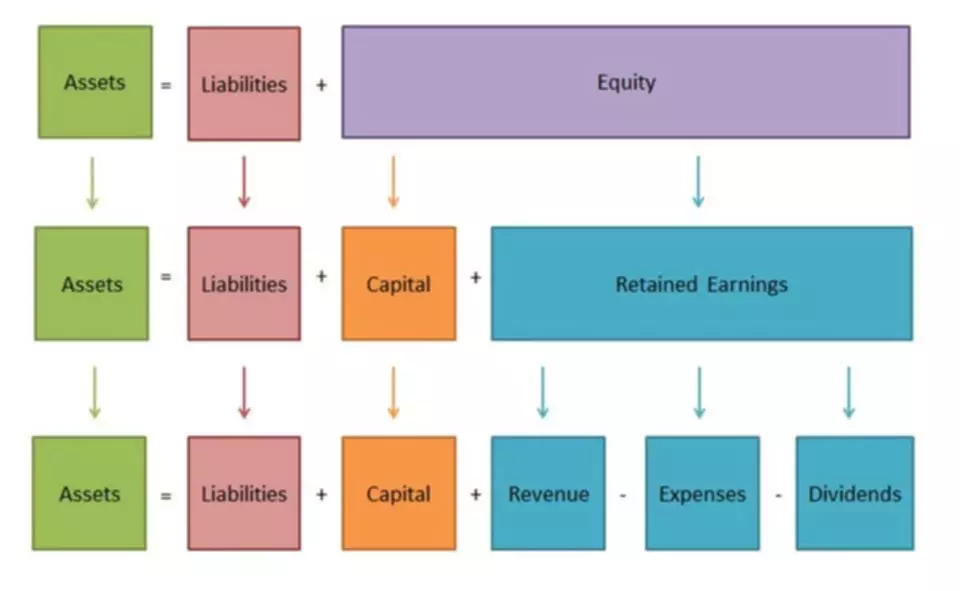

Unlike for-profits, a nonprofit does not have ‘equity’ but ‘net assets.’ Net assets are left after subtracting liabilities from assets. One way to ensure your nonprofit has reliable, up-to-date financial data is with a solid, professional bookkeeping and accounting department. When you work with our nonprofit bookkeepers and accountants, you’ll have a complete team of trained experts behind you, answering questions and making recommendations to help you succeed. A bookkeeper is not required to analyze transactions and often lacks the experience and education to do so effectively. Instead, they focus on laying the foundation for the accounting processes that will follow. They make sure everything is organized and correct so that any and all financial reports are also accurate and ready for the accountant to review and analyze.

Best Accounting Degrees Online – Forbes

Best Accounting Degrees Online.

Posted: Tue, 14 Feb 2023 16:26:26 GMT [source]

While this is fine for most of their needs, applying this method to accounting often results in disaster. You wouldn’t let just anyone manage your personal finances, so don’t let just any volunteer or unqualified staff member keep your nonprofit’s books.

Find a Nonprofit-Friendly Bookkeeping Solution

The idea of fund bookkeeping for nonprofits, which emphasizes accountability rather than profits, is the primary difference between for-profit and non-profit standards. Non-profits often have a variety of general ledgers, or funds, as opposed to profit entities, which have a single self-balancing account. Tax payments, financial reporting, and recordkeeping are handled differently by non-profit organizations than by for-profit enterprises. Your accounting obligations differ from those of for profit organizations if you operate a non-profit group. Nonprofit bookkeepers oversee the day-to-day operations of the organization. To avoid mixing personal and corporate accounts, open a bank account for the non-profit. A bookkeeper may assist with software selection as well as support and training.